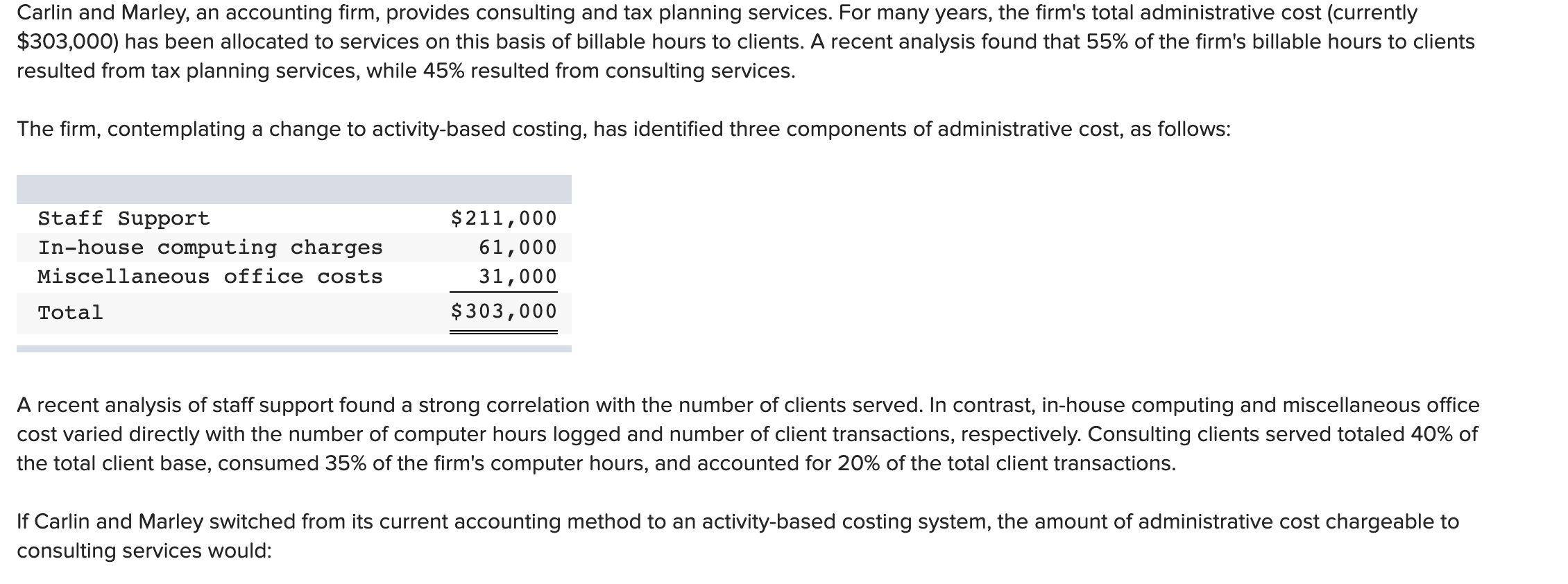

tax planning services fees

The tax service fee is one of a variety of closing costs or fees assessed when a mortgage becomes official and a home sale is completed. However the tax service fee is less.

Tax Planning Services In Stuart Fl Davies Wealth Management

These included an estate.

. Free 3-Year Tax Review Pay Our Fee Find a Location 801-890-4777 Schedule. To learn more about. You must be clear on what the different parts of the engagement are to avoid any confusion.

To make strategic tax planning decisions you need a proactive partner who understands your goals and can create a plan to get you there. Individual 1040 long itemized deductions. Fees for tax planning and advisory services average as much as five times those for tax preparation according to a recent survey of practitioners.

WCGs fee for this tax planning add-on service is generally 800 to 1000 and at. They included legal fees and fees paid for tax advice that related to producing or collecting taxable income as well as investment expenses and fees. Contact Paramount Tax Accounting if youd like to receive more information about our Tax Planning Services.

Clearly convey the value of your service. As a fee-only firm youll have transparency on the costs associated with your plan and you wont have to worry that our advice is based on commissions or hidden fees. As of five years ago estate planning fees used to be tax deductible.

Tax planning financial advisors may charge 100 to 400 an hour depending on their level of professional certification and experience and the complexity of the. Once we have reviewed the prior years tax return a fixed fee quote is given based on our. Unfortunately due to the Tax Cuts and Jobs Act of 2017 TCJA fees you pay for estate planning are no longer deductible.

Sanchez Zures LLC prepares federal and state tax returns for individuals. Even if you have a CPA you may not be. The study from Intuit.

Small businesses average per quarter 175-500. Quarterly Quickbooks Review and Reconciliation. If youre careful structured legal fees can allow tax-free compounding defer taxes and help build a solid financial plan.

Before the TCJA the Internal Revenue Code Section 212 allowed individuals to deduct all the ordinary and necessary expenses incurred in the production of income which. As such the tax planning for determining the efficacy of using this tax deduction is challenging.

What Is The Cost Of Tax Preparation Community Tax

Tax Planning Preparation Services In Chicago Il Lewis Cpa

Solved Carlin And Marley An Accounting Firm Provides Chegg Com

Tax Planning Ryan Reiffert Pllc

Tax Planning Services In Stuart Fl Davies Wealth Management

Lottsa Tax Accounting Services Tax Planning

Income Tax Services Arrighi Blake Associates Llc Certified Public Accountants

Solved Carlin And Marley An Accounting Firm Provides Chegg Com

Pricing Billing And Collecting Fees

Ep Caine Associates Cpa West Chester Tax Planning Pa 19380 West Chester Pa Tax Planning Tax Planning West Chester Pa 19380 West Chester Tax Planning Services

Tax Preparation Services Reliant Consulting Incorporated

Us Tax Services Bellingham Accountant Erin Schlichting Cpa

Services And Fees Empowering Finance Financial Planning In Portland Or

Amazon Com Tax Planning Made Simple 9781925952544 Gleeson Darren Books

Tax Preparation Tax Planning Services Focus Financial Services Llc

Reliable Tax Planning Service In North Carolina Hrmb Associates